Elevate Your Tax Business with Exclusive IRS Access

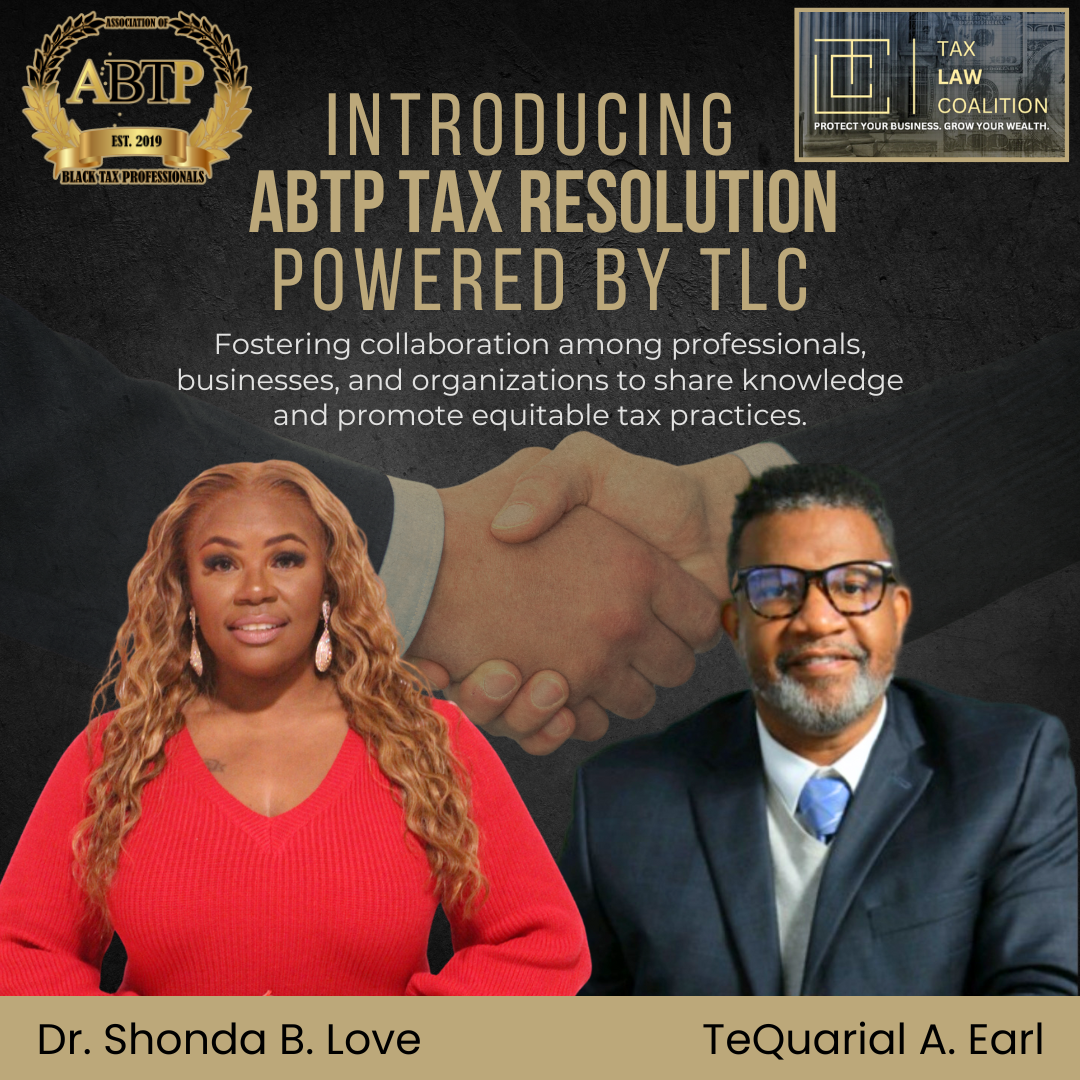

ABTP Tax Resolution Powered by Tax Law Coalition

Includes access to Former Senior IRS Attorneys, Expert Mentorships and Profit Sharing – Expand your services and boost revenue wihtout a proportional increase in workload.

Value: $12,000

Yours for Just $249/Year!

(Introductory Price Requires ABTP Members Only Membership. First 30 days only – $499/year afterwards)

- Unmatched IRS Expertise: “911” emergency-style email access to former IRS attorneys from the IRS’ Office of Chief Counsel—the nation’s largest, and most prestigious tax law firm.

- Timely Legal Guidance: Immediate expert advice for complex tax situations ensures your clients receive top-tier service and quick resolutions.

- Exclusive Mentorship: Monthly Q&A webinars with former IRS attorneys provide actionable strategies to help scale your business while ensuring compliance.

- Business Growth Without Added Work: Increase revenue by referring tax resolution clients and earning 10% of resolution earnings without a proportional increase in workload.

- Proactive Tax Resolution Support: Offer your clients seamless access to IRS-level tax resolution services, elevating the value you provide.

- Priority Lead Access: Gain early access to tax resolution leads on a first come, first serve basis, giving you a competitive edge in growing your client base.

- Increased Client Retention: By expanding your services with high-level tax resolution solutions, you strengthen client loyalty and satisfaction.

- Comprehensive Compliance Confidence: With former Senior IRS attorneys guiding you, confidently navigate complex compliance challenges and mitigate risks.

- Affordable Access to Premium Resources: All these high-value services for just $249 per year, offering an exceptional return on investment.

- Passive Income Opportunities: Referring clients for tax resolution allows you to create a consistent, additional income stream while focusing on your core business.

Meet The Team

TeQuarial A. Earl

CEO

TeQuarial, known as T, is an accomplished Human Resources professional and business strategist with over 20 years of experience. He holds a BA in Organizational Communication with a minor in Business from the University of Texas at Arlington. T has been instrumental in expanding accounting firms into new markets, particularly in Texas and the Southwest, where he identified growth opportunities and developed tailored solutions for emerging industries. His expertise includes market expansion, client engagement, and IRS representation services, making him a key player in driving business growth. T’s commitment to fostering relationships with CEOs, executives, and solopreneurs has helped him generate valuable partnerships and leads. A lifelong learner, T prides himself on helping others succeed and values family time with his two daughters. He is a member of Kappa Alpha Psi, Inc., and a former collegiate/high school basketball athlete winning a championship under Hall of Fame Coach Robert Hughes, reflecting his strong work ethic and competitive nature.

Garrett Gregory

Chief Tax Law Counsel

Garrett has over 12 years of experience as a Senior Attorney with the IRS Office of Chief Counsel. His career began as an International Tax Associate at PricewaterhouseCoopers in San Jose, California, where he gained foundational expertise in global tax strategies. Garrett later joined the IRS’ National Office in Washington, D.C., focusing on international taxation of financial institutions and products. His distinguished IRS tenure continued in the Dallas field office, where he specialized in handling complex individual and business audits.

During his time at the IRS, Garrett also served on the IRS’ International Field Counsel and acted as the Industry Counsel for Subchapter S Corporations. He successfully litigated multiple cases before the U.S. Tax Court, achieving favorable outcomes in each case. His extensive experience provides him with deep substantive tax knowledge and a unique insider’s perspective on IRS procedures, both of which he now leverages to skillfully resolve his clients’ tax disputes.

Garrett holds a Bachelor of Science from Pennsylvania State University, a Juris Doctor from South Texas College of Law, and a Master of Laws (LL.M.) in Taxation from Boston University.

Vince Simon

VP of Business/Strategic Partnership

Vince is a seasoned expert in the financial services industry, with a decade of experience helping tax professionals elevate their practices. Specializing in consulting tax advisors, Vince excels at integrating advanced planning and sophisticated tax strategies that cater to affluent clients and business owners. His approach not only enhances the value offered to clients but also enables tax professionals to scale their revenue streams significantly without a proportional increase in workload.

A political science major from Kent State University, Vince’s entrepreneurial drive led him to a career in sales and consulting, where he quickly made a name for himself by unlocking untapped potential within tax practices. One of his standout achievements includes helping a CPA firm generate an additional $2 million in revenue in just 10 months. Vince’s expertise and results-driven strategies make him a sought-after consultant for tax professionals looking to grow their businesses to new heights.

Deborah Gregory

Tax Law Counsel

With over 12 years of distinguished service as a Senior Attorney for the IRS Office of Chief Counsel, she possesses unparalleled institutional knowledge of the IRS—insight that few outside the organization can offer. Her deep understanding of IRS operations and tax law enables her to craft highly effective solutions for clients facing complex tax issues.

Mrs. Gregory holds a Juris Doctor from South Texas College of Law and a Master of Laws (LL.M.) in Taxation from Boston University, further solidifying her expertise in tax law. Her unique combination of IRS experience and advanced legal credentials makes her exceptionally qualified to navigate even the most challenging IRS matters on behalf of her clients.

In addition to her professional achievements, Mrs. Gregory is a dedicated wife and proud mother of two boys.